2025-2026 Raw Material Supply Chain Issues Push Motor Prices Higher

January 12, 2026Vybronics’ motors rely heavily on two specific elements: Neodymium (Nd) and Tungsten (W). Over the past 12 months, the global markets for these two critical materials have experienced unprecedented volatility. We believe in transparency with our partners, so today we are sharing an analysis of these market shifts and explaining why we must increase prices effective Q1 2026.

Why We Use These Materials

To understand the impact of the current market, it helps to understand why these materials are non-negotiable in high-performance micro-actuators.

- Neodymium: The Heart of the LRA In a Linear Resonant Actuator, a spring-mounted mass moves back and forth through a magnetic field. To get a “punchy” start and stop (high acceleration), you need an incredibly dense magnetic field. We use Neodymium-Iron-Boron (NdFeB) permanent magnets. Neodymium is the strongest commercially available magnetic material. It allows us to create the powerful magnetic flux necessary to drive the voice coil efficiently within tight geometric constraints. Standard coin and cylindrical ERM motors also utilize Neodymium based magnets as well.

- Tungsten: The Source of the Force A vibration motor works by spinning an Eccentric Rotating Mass (ERM). An LRA works by oscillating a mass linearly. In both cases, the force of vibration is directly proportional to the density of that mass. We cannot use steel or brass; they simply aren’t heavy enough for modern ultra-thin devices. We use Tungsten heavy alloys. With a density akin to gold, Tungsten allows us to pack maximum inertia into the smallest possible volume, maximizing vibration strength without increasing device thickness.

The 2025 Commodity Surge: A Year Like No Other

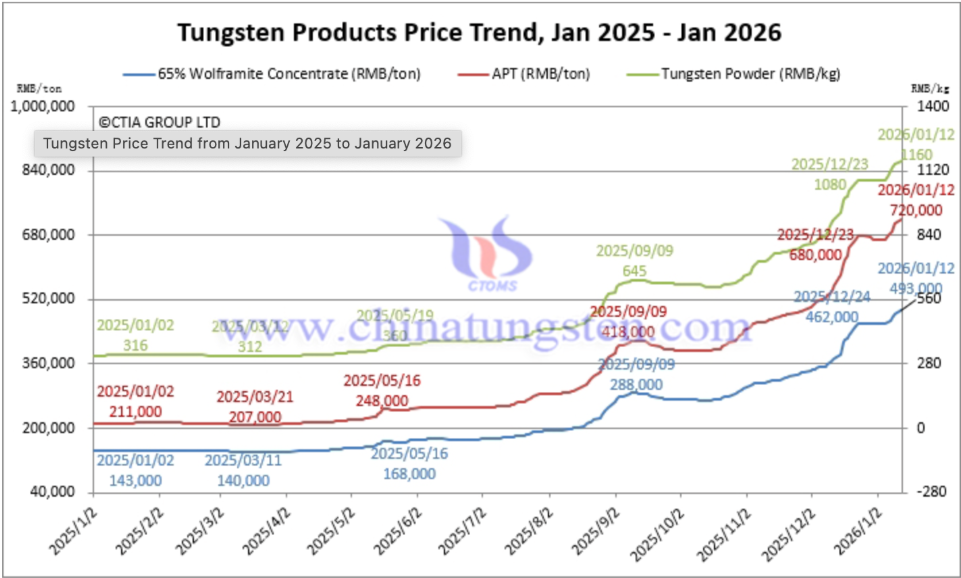

We closely monitor the Chinese spot markets, where the vast majority of refining for these elements occurs. Between January 2025 and January 2026, the pricing models for both materials fundamentally broke away from historical norms.

Below is an analysis of the percentage increases based on domestic Chinese RMB spot prices over the last 12 months.

The Tungsten “Hyper-Spike”: >240% Increase

Tungsten saw the most dramatic rise we have witnessed in decades.

The Tungsten market was hit by a “perfect storm.” While mining quotas in China tightened, an entirely new industry—photovoltaic (solar) manufacturing—aggressively pivoted to using Tungsten diamond wire for cutting silicon wafers. This new, massive demand vertical effectively drained the market of raw supply (Ammonium Paratungstate or APT) before it could reach industrial tool and motor manufacturers. This wasn’t just a price hike; it was a physical shortage that drove prices up over 240% in a single year.

The Neodymium Policy Shift: ~55% Increase

Neodymium prices also saw a significant increase as well.

The rise in Neodymium-Praseodymium (NdPr) oxide, the primary input for our magnets, was driven by structural changes in China’s materials policy. Through 2025, changes in quota management and the establishment of firmer state-backed pricing floors effectively removed low-cost supply from the market. While material is available, the new “floor price” is ~55% higher than it was at the start of 2025.

The Path Forward for 2026

These two materials constitute a significant percentage of the total Bill of Materials (BOM) cost for any high-performance micro-actuator.

Throughout 2025, Vybronics made a strategic decision to absorb these escalating costs. We utilized forward-buying contracts and sacrificed our own margins to maintain price stability for our long-term customers during a turbulent economic year.

However, the data indicates that these new price levels are the “new normal,” not a temporary spike. A combined input cost increase ranging from 55% to over 200% on our primary raw materials is no longer sustainable through absorption alone.

To maintain the quality standards and reliable supply you expect from us, we must implement a pricing adjustment across our product lines effective for Q1 2026 orders.

This is not a decision we take lightly. We are currently recalculating standard costs based on specific model compositions—as LRAs using more tungsten will be affected differently than coreless DC motors using more neodymium. Contact us for a revised quote before placing a new purchase order.